The Anatomy of the Alleged Pump-and-Dump Schemes

In the summer of 2025, a sophisticated and widespread series of “pump-and-dump” schemes targeting U.S.-listed, small-cap Chinese companies came to light, resulting in catastrophic losses for retail investors. National law firm Morris Kandinov LLP has launched investigations into several of these cases, including those involving Park Ha Biological Technology Co., Ltd. (NASDAQ: PHH), Top KingWin Ltd (NASDAQ: WAI), PicoCELA Inc. (NASDAQ: PCLA), and EPWK Holdings Ltd (NASDAQ: EPWK).

These schemes, which have drawn scrutiny from federal law enforcement and regulatory bodies, represent a modern evolution of a classic financial fraud, leveraging social media and encrypted messaging apps to manipulate stock prices on a massive scale. The operations were characterized by a coordinated effort to artificially inflate the value of thinly traded stocks through false and misleading promotions, only for the orchestrators to sell their shares at the peak, leaving unsuspecting investors with near-worthless holdings when the price inevitably collapsed.

The scale of the fraud was immense, with one coordinated event in July 2025 alone wiping out an estimated $3.7 billion in market capitalization across seven targeted companies . The Federal Bureau of Investigation (FBI) reported a staggering 300% year-over-year increase in complaints related to such “ramp-and-dump” frauds in 2025, underscoring the growing prevalence and impact of these criminal activities.

Click here to read the full report.

Overview of the Scam Operations

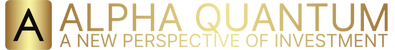

The operational blueprint for these pump-and-dump schemes was remarkably consistent across the targeted companies, indicating a coordinated and sophisticated criminal enterprise. The process began with the identification of suitable targets: typically micro-cap or small-cap Chinese companies listed on U.S. exchanges like NASDAQ. These companies often had limited public floats, low institutional ownership, and minimal analyst coverage, making their stock prices more susceptible to manipulation.

The scammers would then initiate a multi-phase campaign designed to create a false sense of legitimacy and urgency, driving retail investor demand to unsustainable levels before executing a coordinated sell-off. This modern approach to an old fraud weaponized social media platforms and encrypted communication apps, creating a potent and deceptive trap for investors who were often lured by the promise of quick and guaranteed returns.

The WhatsApp and Social Media Trap

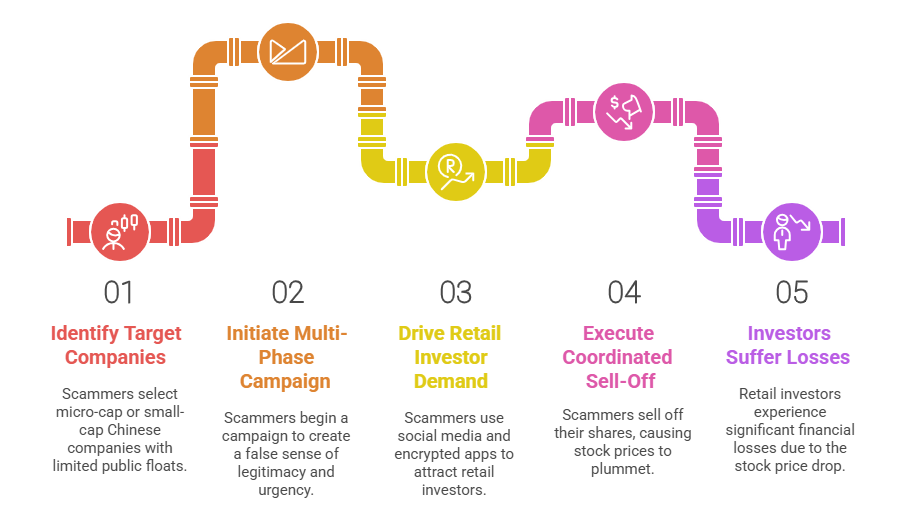

The primary mechanism for recruiting victims was through a sophisticated digital marketing funnel that began with fraudulent advertisements on popular social media platforms like Facebook and Instagram. These ads often featured deepfake videos of well-known financial figures or used stolen professional headshots and names from legitimate financial firms to create an aura of credibility. When a potential victim clicked on one of these ads, they were typically directed to join a closed, members-only investment group on a secure messaging application like WhatsApp or WeChat.

These groups were carefully curated to appear as vibrant, exclusive communities of like-minded investors. However, in reality, they were populated by a mix of bots, fake accounts, and paid affiliates who engaged in scripted conversations to build hype and a false sense of consensus around specific stock picks.

This tactic created a powerful “fear of missing out” (FOMO) among genuine members, who were led to believe they were part of a select group receiving privileged, high-return investment advice. The scammers would often provide a few initial “tips” on large, stable stocks that yielded small gains, a classic confidence-building maneuver designed to lower the victims’ guard and establish trust before the main event.

Impersonation of Reputable Financial Institutions

A critical element of the deception was the impersonation of established and trusted financial institutions and professionals. Scammers operating within the WhatsApp and WeChat groups frequently posed as licensed financial advisors, wealth managers, or analysts from well-known firms such as Merrill Lynch or Capital Wealth Planning, LLC.

They used professional-sounding titles, official-looking marketing materials, and even provided seemingly legitimate investment cases and market news updates to bolster their credibility. In one instance involving the stock Pheton Holdings (PTHL), scammers used deepfake social media adverts featuring prominent figures from the financial sector to promote the stock, a tactic sophisticated enough to fool even a senior professional working at a UK bank.

This impersonation was not limited to individuals; entire “investment academies” or “trading programs” were fabricated, complete with a “professor” or “teacher” figure leading the group . By cloaking themselves in the legitimacy of recognized brands, the fraudsters were able to overcome the natural skepticism of their targets and lend an air of authority to their fraudulent recommendations, making the promise of guaranteed returns of 15-25% within days seem plausible.

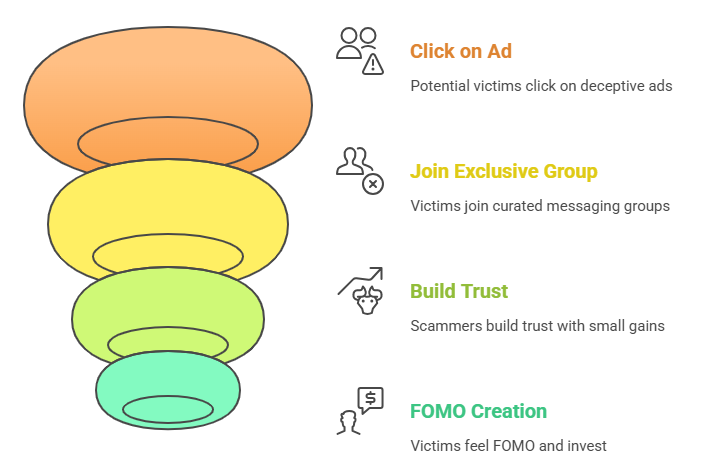

The “Pump” Phase: Artificially Inflating Stock Prices

Once the scammers had gained the trust of their victims, they would initiate the “pump” phase. This involved aggressively promoting a specific low-priced stock, such as PHH, WAI, PCLA, or EPWK, as a “can’t-miss” or “star investment opportunity” . The promotion was built on a foundation of lies, often centered around fabricated material events.

For example, in the case of Pheton Holdings, scammers spread false rumors of an impending acquisition or partnership with a major pharmaceutical company, Gilead Sciences, to create a sense of an imminent, market-moving catalyst . Victims were subjected to intense pressure tactics, including urgent deadlines and warnings that the opportunity was limited, to force them to act quickly without conducting proper due diligence.

The scammers would instruct group members to buy the stock through their own legitimate brokerage accounts, which reassured investors that they maintained control over their money. As the coordinated buying from hundreds or thousands of victims accumulated, the stock price would begin to surge, creating a self-fulfilling prophecy that validated the scammers’ predictions and drew in even more investors, further inflating the price to artificially high levels.

The “Dump” Phase: Coordinated Sell-Off and Investor Losses

The final stage of the scheme was the “dump.” While the victims were busy buying and holding the stock, waiting for the promised massive returns, the scammers – who had secretly accumulated a large volume of shares before the pump began – were preparing to sell. At a pre-determined signal or once the price reached a target level, the orchestrators would execute a coordinated sell-off of their entire holdings. This massive influx of sell orders would cause the stock price to collapse, often within minutes or hours.

For instance, Pheton Holdings (PTHL) lost 90% of its value in a matter of minutes on July 29, 2025, after a research report exposed the potential scam. Similarly, Ostin Technology Group (OST), a comparable case, plummeted over 93% intraday, erasing virtually all gains. The victims, who were still holding their shares, were left with devastating losses, in some cases losing their entire life savings. When they tried to contact the scammers for the promised reimbursement of losses, they were either ignored or given another fraudulent stock tip, perpetuating the cycle of fraud.

Analysis of the Involved Companies

| Ticker | Company | Peak-to-Trough Crash | Key Red-Flags (Scam + Fundamental) | Latest Reported Revenue | Net Result (latest qtr/yr) | Valuation Extremes |

| PHH | Park Ha Biological Technology | –93 % (8 Jul 2025) | • Facebook ads → WhatsApp “PHH Global Trading Club” | 2024 revenue $2.38 m | EBITDA $0.82 m | P/S 420× at top |

| WAI | Top KingWin Ltd | –89 % (15 Jul 2025) | • 1-for-25 reverse split May-25 (classic float-shrink) | Latest qtr ~$0.8 m | Net loss –$663 k | Market-cap briefly >$300 m |

| PCLA | PicoCELA Inc. | –87 % (Feb-Mar 25) | • WA-State DoFI consumer alert 27 Feb 25 | Latest qtr ~$0.78 m | Net loss –$479 k | P/S ~110× at $8.81 peak |

| EPWK | EPWK Holdings Ltd | –81 % (May 2025) | • Revenue-growth story vs negative EPS –$0.37 | FY-2022 $3.1 m | Net loss –$3.4 m | P/S ~60× at $26 top |

In every case the promotional surge created market capitalisations that were 60-420× sales – orders of magnitude above even high-growth tech multiples – while the underlying businesses were either break-even at best or burning cash with minimal revenue. These valuation gaps, coupled with identical social-media impersonation tactics, are the forensic signature of the alleged pump-and-dump campaigns now under investigation by Morris Kandinov LLP.

Multiple federal agencies have taken public action in response to the surge in pump-and-dump scams. The FBI issued a public service announcement on July 3, 2025, confirming a 300% year-over-year increase in victim complaints. The SEC and FINRA are also deeply involved, with FINRA having previously identified key red flags for such schemes.

In addition to government enforcement actions, the primary vehicle for investor recovery in cases of widespread securities fraud is the class-action lawsuit. Morris Kandinov LLP’s investigation is the precursor to filing such a lawsuit on behalf of the victims of the PHH, WAI, PCLA, and EPWK schemes.

A notable example is the case of China Liberal Education Holdings, where seven individuals were indicted for their roles in a pump-and-dump scheme. Federal law enforcement seized approximately $214 million in alleged proceeds from the fraud, and the DOJ filed a civil complaint to have these funds permanently forfeited so they could be returned to the victim investors.

Bottom Line

The Morris Kandinov LLP investigations represent the first organized effort to recover investor losses from what may be the largest coordinated micro-cap pump-and-dump operation since 2008. Victims who purchased PHH, WAI, PCLA, or EPWK after being solicited through fraudulent social-media or WhatsApp campaigns are strongly encouraged to submit their information immediately to preserve their right to participate in any eventual class action or settlement.

Morris Kandinov LLP has made it straightforward for potential victims to come forward and participate in the investigation. The firm has established a dedicated contact point for individuals who believe they were affected by the pump-and-dump schemes involving PHH, WAI, PCLA, and EPWK. Investors are encouraged to visit the firm’s website at https://moka.law/case-contact-form/ to provide their information and details of their losses