Traditional investments just aren’t what they used to be. If you’ve ever checked the interest rates on savings accounts in Dubai (or pretty much anywhere else in the world), you know they’re nothing fancy or exciting. Earning 3-4% a year might help you buy an extra coffee or two, but it’s barely enough to keep up with the rising cost of living, let alone actually grow your wealth.

Government bonds? Sure, they’re safe. But “safe” often means settling for returns in the 4-5% range. It’s steady, but it’s hardly exciting. Then there are corporate bonds, which sometimes promise a bit more (maybe 3–9% a year). But that usually comes with extra risk, and pages of fine print.

That leaves us with stock trading. The potential for big gains. But we all know how unpredictable the markets can be. If your stocks go up, you’re in the green and feeling great. But if they head south, you could be dead in the water before you know it. It’s a rollercoaster ride, and not everyone has the stomach (or the time) for it. I know I don’t.

Which begs the question: do we have any other option?

Is there a way to aim for higher returns? Without exposing yourself to the wild west of the stock market? Or settling for the low yields of traditional investments is our only option?

Well, there is one solution in the market. It’s called an Autocallable Memory Note. It gives you returns up to 16.50% per year (paid on a monthly basis @1.375%) while still giving some protection for your investment.

And it might just be the solution you’ve been looking for.

1. What Is Alpha Quantum Group’s Autocallable Memory Note

In Simple Terms:

- It’s not a stock, not a bond, but a “structured note.”

- You earn a high monthly payout (1.375% per month, or 16.50% per year) as long as certain conditions are met.

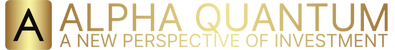

- Your investment is linked to three tech giants: Microsoft, NVIDIA, and Tesla.

- You have some capital protection – so you’re not fully exposed to market crashes.

- It can end early if the market does well, so you get your money back (plus all earned monthly interests) sooner.

Let’s break down how it works, step by step.

The Basics

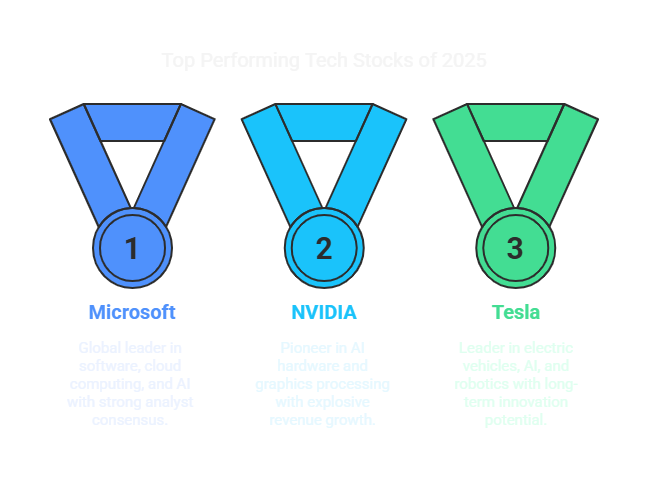

- You invest a lump sum (in USD) for up to 3 years.

- Every month, you could receive a coupon payment (like interest), as long as none of the three stocks falls below a certain level.

- If the market is strong, the product can “autocall” (redeem early), paying you back your capital and all earned coupons.

- If the market is weak, you have protection – unless one of the stocks falls dramatically.

The “Worst-Of” Mechanism

This product is linked to the worst-performing stock among Microsoft, NVIDIA, and Tesla.

- If they all do well, you get paid.

- If one stumbles, your returns depend on how badly that one does.

2. Key Features of the Alpha Quantum Group Product

1. Underlying Stocks

- What you’re linked to: The performance of Microsoft, NVIDIA, and Tesla.

- How it’s measured: The “worst performer” among these three stocks at certain checkpoints determines what happens next.

2. Coupon Payments

- How much: 16.5% per year (paid as 1.375% per month).

- When: Every month, as long as the worst stock is above a certain level (the “Coupon Barrier,” which is 60% of its starting price).

- Memory Feature: If a coupon is missed because the worst stock is below the barrier, and then the stock recovers, you might get extra coupons later (this is the “memory” part).

3. Autocall Feature

- What it means: The product can end early if the worst stock is at or above its starting price (the “Autocall Barrier,” which is 100%).

- When it happens: Every 6 months, starting from month 6, the bank checks if the worst stock is above this level. If it is, the product is “called” (redeemed early), and you get your money back plus all the coupons you’ve earned so far.

4. Maturity and Protection

- How long it lasts: Up to 3 years (36 months).

- Capital protection: If the worst stock drops below 60% of its starting price and stays there, you could lose some of your investment, but not all. The documents show you’d get back a percentage of your capital depending on how far the worst stock falls.

- Payoff at maturity: If the product isn’t called early, at the end of 3 years, you get a payout based on the performance of the worst stock. If the worst stock is above its starting price, you get your money back plus extra. If it’s below, you might get less than your original investment, but with some protection if the drop isn’t too severe.

5. Who Is This Product For?

- You want income: If you’re looking for regular, above-market interest payments.

- You’re neutral or moderately bullish/bearish: If you’re not sure if the market will go up or down, but you don’t expect a huge crash.

- You can handle some risk: There’s a chance you could lose some money if the worst stock drops a lot and stays down, but there’s also a lot of protection compared to just buying the stocks outright.

6. Why Consider This Product?

- High income potential: The coupon is much higher than what you’d get from a savings account or most bonds.

- Some protection: You’re not fully exposed to a big drop in the stock market.

- Flexibility: The product can end early if the market does well, letting you reinvest your money sooner.

3. How Does It Work?

1. Coupon Payment When Worst of Stock Is Above 60%

- You receive the full monthly coupon each month.

- No early autocall or maturity event occurs within this period.

2. No Coupon Payment When Worst Stock Is Below 60%

- No coupon payments are made in any month.

- No early autocall or maturity event occurs within this period.

3. Memory Feature When Worst of Stock Returns to Above 60%

- No coupon payments for the first 5 months.

- In month 6, you receive the regular coupon plus a memory coupon (sum of missed coupons: 5 × 1.375% = 6.875%).

- From month 7 onward, you receive the regular monthly coupon.

4. Maturity After 3 Years

- You receive the monthly coupon every month.

- At month 36, the product matures.

You get back your full amount + coupon for that month

5. Early Maturity (Autocall) When Worst of Stock Is Above 100% (After 6 Months)

- In month 6, the worst stock jumps above 100%, triggering an early autocall.

- You receive all coupons up to month 6, plus your principal.

- No further events occur after month 6.

Summary Table

| Case Name | Key Points |

| Coupon Payment Above 60% | – Worst stock always above 60%- Receive full coupon every month |

| No Coupon Below 60% | – Worst stock always below 60%- No coupon payments |

| Memory Feature Return Above 60% | – Worst stock recovers above 60% after 5 months- Missed coupons paid in month 6 |

| Maturity After 3 Years | – Worst stock always above 60%- Product matures at end of term |

| Early Maturity Above 100% | – Worst stock above 100% at month 6- Product autocalls and matures early |

4. How does the autocallable memory note protect my capital in Dubai’s market

This Autocallable Memory Note protects your capital through multiple structured safeguards, particularly relevant in volatile markets like Dubai’s. While the product isn’t geographically specific to Dubai, its capital protection mechanisms are designed to mitigate downside risk regardless of market conditions. Here’s how it works:

Capital Protection Mechanisms

1. Barrier-Based Safeguards

The note uses three key barriers at 60% of each stock’s initial price:

- Coupon Barrier: Suspends monthly coupons if any stock falls below 60%, but doesn’t trigger capital loss.

- European Barrier (60%): Determines final capital recovery at maturity.

- Gear Put Barrier (60%): Defines the threshold for capital reduction if breached at maturity.

2. Maturity Payout Structure

If the note isn’t autocalled early, your capital protection depends on the worst-performing stock at maturity:

| Worst Stock Performance at Maturity | Capital Recovery |

| Above 60% of starting price | 100% of your investment |

| 60% of starting price | 100% of your investment |

| 50% of starting price | 83.33% of your investment |

| 40% of starting price | 66.67% of your investment |

| 30% of starting price, or below | 50% of your investment |

This ensures you never lose your entire investment, even in severe downturns.

3. High Probability Early Exit

- Autocall Trigger: If any stock is at/above its initial price during semi-annual checks (starting at month 6), the note terminates early. You receive 100% principal plus all accrued coupons.

- Historical simulations show a 96.24% autocall probability, meaning capital is typically returned within 6-18 months.

4. Memory Coupon Feature

Missed coupons (due to stocks below 60%) accumulate and are paid later if stocks recover, enhancing income stability without risking principal.

Why This Works in Volatile Markets

- Diversified Exposure: Tied to three leading tech stocks (MSFT, NVDA, TSLA), reducing single-asset risk.

- Backtested Resilience: 1,304 historical simulations showed 100% capital return (including autocalls), even during market downturns.

- Structured Downside Floor: The 60% barrier and gear put mechanism cap maximum loss at 50% of principal, providing predictable risk parameters.

Dubai Market Considerations

While not Dubai-specific, the product’s USD denomination and Barclays’ global issuance make it accessible there. Its capital protection is particularly valuable in regions with high market volatility, as the barriers and autocall mechanisms actively limit exposure to prolonged downturns.

This combination of conditional income, early exit triggers, and graduated capital recovery creates a balanced risk profile for cautious investors seeking equity-linked opportunities.

5. What risks come with Alpha Quantum Group’s 16.50% Autocallable Memory Note

1. Your Investment Is Linked to Stock Performance

- The Autocallable Memory Note is not a traditional bond. Instead of being backed by the issuer’s ability to pay, your returns depend on how three stocks – Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) – perform over the life of the product.

- Specifically, the note tracks the worst-performing stock among these three.

2. The High Coupon Doesn’t Guarantee Your Capital

- The 16.50% coupon is a reward for taking on this risk. It’s only paid if the worst stock stays above the 60% barrier at each monthly observation.

- If the worst stock falls below the barrier, you may miss coupons (although the “memory” feature means missed coupons can be paid later if the stock recovers).

- If the worst stock is still below the barrier at maturity, you lose part of your initial investment – regardless of how many coupons you received.

3. What If the Market Crashes?

- If a major market downturn causes one of the three stocks to fall sharply and stay low, you could lose a significant portion of your investment.

- This is the main difference from a traditional bond, where you usually get your full principal back unless the issuer defaults.

4. Historical Backtest Results (1, 300+ historical simulations from 2017 to 2022):

- 100% of all coupons were paid (meaning, in backtested scenarios, the stocks rarely fell below the coupon barrier).

- 96.24% of the time, the product was “autocalled” early (meaning the stocks performed well enough that you got your money and coupons back early).

- Full principal was repaid 100% of the time in the backtest.

However, past performance is not a guarantee of future results. If future market volatility is higher than in the past, there’s a greater risk of missing coupons.

6. What risks should I consider if early redemption occurs before maturity

If the worst-performing stock (Microsoft, Nvidia, or Tesla) is at or above its starting price during a monthly observation (after month 6), the product is “autocalled.” This means:

- You receive your full invested capital back

- You receive all accrued coupons up to that point

- The investment ends early (before the full 3-year term)

Does Early Redemption Happen Often?

- According to the product’s backtest (2017–2022, 1300+ simulations), early autocall occurred 96.24% of the time. This means most investors got their money back early, along with all coupons earned up to that point.

- This is because the underlying stocks (MSFT, NVDA, TSLA) often performed well enough to trigger the autocall barrier.

| Risk Type | What It Means | Why It Matters |

| Reinvestment Risk | Getting money back early but struggling to find similar high-yield investments | Next investment may offer lower returns if rates/market conditions change |

| Missed Upside Potential | Losing future high coupon payments if markets keep performing well | Early exit could mean less total income than full 3-year term |

| Shorter Investment Horizon | Disruption to planned 3-year investment timeline | Forces earlier reinvestment, potentially at unfavorable times |

| Tax Implications | Possible tax consequences from receiving lump sum earlier than expected | May owe taxes sooner or at higher rate depending on jurisdiction |

| Market Timing Risk | Receiving funds when market peaks, risking reinvestment during decline | Could reinvest at market highs before subsequent downturn |

Think of the autocall trigger like a finish line in a race. In calm weather (low volatility), runners (stocks) are more likely to cross the finish line together quickly. In stormy weather (high volatility), one runner might stumble or fall behind, delaying everyone from finishing early.

7. Bottom Line

The Autocallable Memory Note offers a rare combination: high income potential, regular payouts, and a degree of capital protection.

It’s not for everyone. But for investors who want more than what the bank offers, and are willing to accept some market-linked risk, it’s a compelling alternative.

Remember:

- Understand the product.

- Know your risk tolerance.

- Consult with a financial advisor if you’re unsure.

Ready to explore smarter ways to grow your wealth?

Alpha Quantum Group’s Autocallable Memory Note could be your next step forward.

Disclaimer: This article is for informational purposes only and is not investment advice. Past performance is not indicative of future results. Please consult a financial advisor before making investment decisions.

FAQs

Product Basics & Mechanics

A Memory Autocallable Note is a structured investment product that provides regular monthly income payments of 1.375% (16.50% annually) linked to the performance of underlying equity assets. The “memory” feature ensures that any missed payments due to market downturns are automatically recovered and paid when conditions improve.

On each monthly observation date, if the underlying assets are trading at or above predetermined barrier levels (typically 60-70% of initial levels), the product pays 1.375% and continues. If assets perform exceptionally well (usually above 100% of initial levels), the product may “autocall” – terminating early with full capital return plus accumulated returns.

Autocall occurs when underlying assets close at or above the autocall barrier (typically 100% of initial value) on a monthly observation date. When this happens, you receive your full capital plus all earned returns, and the investment terminates successfully.

If underlying assets fall below the coupon barrier on any monthly observation date, no payment is made that month, but the payment is “remembered.” When assets recover above the barrier, you receive the current month’s payment PLUS all previously missed payments in a single distribution.

If assets remain below barriers for the entire 3-year term, you still receive all remembered payments at maturity, provided capital protection levels haven’t been breached. The memory feature ensures no income is permanently lost due to timing.

- Autocall Barrier (100%): Assets above this level trigger early profitable termination

- Coupon Barrier (60-70%): Assets above this level generate monthly payments

- Capital Protection Barrier (40%): Assets below this level may result in capital loss

Maximum term is 36 months, but historical data shows 96.24% of investments terminate early (average 12-18 months) when autocall conditions are met, providing full returns in shorter timeframes.

Underlying Assets & Performance

High-quality, established companies such as:

- Microsoft Corporation (MSFT)

- Apple Inc. (AAPL)

- JP Morgan Chase & Co. (JPM)

- Other blue-chip stocks with strong long-term prospects

- Sometimes broad market indices

Selection criteria include:

- Market capitalization > $100 billion

- Daily trading volume > $1 billion

- Historical volatility within acceptable ranges

- Strong fundamental business metrics

- Liquidity for product unwinding if needed

Generally, no

Assets are pre-selected by structuring teams based on optimal risk-return profiles.

However, for large investments ($1M+), customized baskets may be possible.

Structured products include provisions for extraordinary events:

- Asset substitution with equivalent securities

- Early termination with pro-rata settlement

- Adjustment of terms to maintain product integrity

- Investor notification and consent processes

Dividends from underlying assets typically flow to the product issuer and are factored into the overall return calculation. Your 1.375% monthly payments are separate from and in addition to underlying dividend performance.

Payments & Returns

Payments are made approximately 5 business days after each monthly observation date (typically month-end). Exact payment dates are specified in your investment documentation and follow a predetermined schedule.

Monthly payment = (Investment Amount × 1.375%) paid when underlying assets are above coupon barriers. For a $100,000 investment, this equals $1,375 per month when conditions are met.

During volatile periods when assets fluctuate around barrier levels:

- Payments are made only when barriers are exceeded on observation dates

- Missed payments accumulate via the memory feature

- Recovered payments include all previously missed amounts

- No payments are permanently lost due to volatility timing

No . The 16.50% represents the potential annual return if all monthly payments are made. Actual returns depend on underlying asset performance and barrier level maintenance throughout the investment period.

If the product runs the full 36 months with all payments made: 36 × 1.375% = 49.50% total return plus capital. However, early autocall (which occurs 96.24% of the time) typically results in 16.50-33% total returns.

USD-denominated products eliminate currency risk for USD-based investors. Non-USD investors face currency conversion risk when funding and receiving distributions, which should be considered in overall return calculations.

Capital Protection & Risks

Capital protection means that even if underlying assets decline, your principal is protected down to a 40% loss in the underlying assets. If assets fall from $100 to $40 (-60%), your capital protection barrier is breached and losses may occur.

If underlying assets fall below the protection barrier (typically 40% of initial value) at maturity:

- You may receive less than your original capital

- Loss is typically proportional to the decline below the barrier

- All remembered coupon payments are still paid

- Exact loss calculations depend on final asset levels

According to historical data, 100% of capital has been returned across all previous Memory Autocallable investments. However, past performance doesn’t guarantee future results, and capital loss remains possible if protection barriers are breached.

- Market Risk: Underlying asset performance affects payments and capital

- Credit Risk: Issuer financial strength impacts product security

- Liquidity Risk: Early exit may not be possible or may incur losses

- Complexity Risk: Product mechanics require understanding

- Interest Rate Risk: Changes may affect product valuations

These are generally illiquid investments designed to be held to autocall or maturity. Secondary market sales may be possible but could result in significant losses due to bid-ask spreads and market conditions.

Issuers are typically major investment banks with credit ratings of A- or higher from major rating agencies (S&P, Moody’s, Fitch). Specific issuer details are provided in investment documentation.

Operational & Administrative

These are over-the-counter (OTC) structured products, not exchange-traded. They’re bilateral contracts between you and the issuing bank, facilitated by Alpha Quantum Group.

- Product term sheet with detailed mechanics

- Final terms document with specific parameters

- ISDA master agreement (if applicable)

- Risk disclosure statements

- Monthly/quarterly performance reports

- Tax reporting documentation

Structured products are regulated under UAE financial services laws and international banking regulations governing the issuing institutions. They’re professional investor products requiring suitability assessments.

- Daily valuation and barrier level monitoring

- Monthly observation date processing

- Quarterly performance reporting

- Continuous issuer credit monitoring

- Regular client communication and updates

Monthly payments are typically distributed to your designated account. Automatic reinvestment into new products may be arranged, but each investment requires separate documentation and suitability assessment.

- Observation dates may shift to next business day

- Payment dates adjust accordingly

- Asset pricing uses last available market prices

- Holiday schedules are detailed in investment documentation

Tax & Compliance

Tax treatment varies by investor jurisdiction:

- Monthly payments may be treated as income

- Capital gains/losses apply to principal changes

- Professional tax advice recommended for optimization

- Annual tax reporting documentation provided

- Annual statements of payments received

- Capital gains/loss calculations

- Issuer tax information (1099s for US persons)

- Supporting documentation for tax filings

Depending on issuer jurisdiction and investor residence:

- US persons may face backup withholding

- Non-US investors may qualify for treaty benefits

- UAE residents typically face no withholding

- Specific situations require individual analysis

Comparison & Alternatives

- Higher yield potential: 16.50% vs typical bond yields

- Equity upside: Linked to stock performance, not just creditworthiness

- Capital protection: Similar to bonds but with higher risk

- Complexity: More sophisticated than traditional bonds

- Liquidity: Less liquid than most bonds

- Downside protection: Capital protection to 60% decline

- Regular income: Monthly payments vs irregular dividends

- Reduced volatility: Structured returns vs full market exposure

- Professional management: No need for individual stock selection

Memory Autocallables focus on:

- Regular monthly income vs capital appreciation

- Shorter investment horizon (3 vs 5 years)

- Immediate payment gratification vs accumulated growth

- Different risk-return profiles for different investor needs

Newsletter Updates

Enter your email address below and subscribe to our newsletter