For many investors, the dream is simple: enjoy the rewards of a rising market, and sleep peacefully knowing your principal is safe. But market volatility is usually seen as a threat! Something to be managed, avoided, or hedged against!

But what if you could turn that volatility into a powerful ally?

The Step-Up Autocallable Note does just that.

By linking rising interest rates to the passage of time and market performance, this product transforms periods of uncertainty into chances for greater returns. If you’re looking for a way to harness the unpredictability of the markets for your benefit, without giving up on the prospect of capital protection, the Step-Up Autocallable Note might be exactly what you need.

These structured products blend the best of both worlds: the potential for high yields and a mechanism that rewards patience, especially in volatile or sideways markets.

Alpha Quantum Group has positioned its MSFT, AAPL, JPM Step Up Autocallable Note as a flagship offering in this category. This article will explore the mechanics, advantages, and practical considerations of Step-Up Autocallable Notes, helping investors understand why these instruments are becoming a staple in growth-focused portfolios.

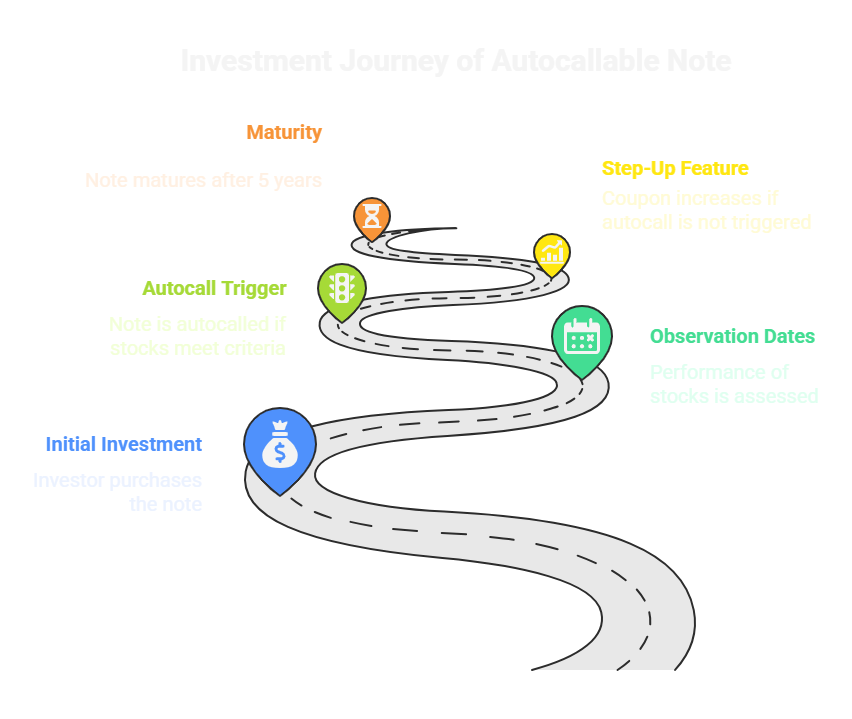

What Is a Step-Up Autocallable Note?

A Step-Up Autocallable Note is a type of structured investment product that combines two powerful features:

- Autocallability: The note can be redeemed (or “autocalled”) before maturity if specific performance conditions are met by the underlying assets.

- Step-Up Value: Your investment value increases, or “steps up,” at each observation period the note is not autocalled.

This structure is designed to reward investors for holding the note through periods of market uncertainty, offering increasing returns the longer the investment remains active.

In Simple Terms:

- You make a single investment and receive a single payout at the end

- Your investment value grows (“steps up”) at set intervals if the note isn’t called early

- Your investment is linked to the performance of selected underlying assets

- The product can end early (autocall) if the market performs well, returning your accumulated investment value

- If held to maturity, you receive whatever your investment value has grown to, but this is subject to the final performance of the underlying assets

Simplified Example: Step-Up Autocallable in Action

Scenario 1: Early Autocall

- You invest $100,000 in a 5-year Step-Up Autocallable Note.

- Your investment value increases by 6% at each annual observation if the note isn’t autocalled.

- If all three stocks are at or above 105% of their initial price at a review, the note is Autocalled and matures early.

| Period | Worst Stock Level | Investment Value | Autocall? | Payout |

| Year 1 | 92% | $106,000 | No | – |

| Year 2 | 101% | $112,360 | No | – |

| Year 3 | 108% | $119,102 | Yes | $119,248 |

Total Return: $100,000 principal.

You benefit from accumulated value growth and get your money back early, but must reinvest sooner (reinvestment risk).

2: Sideways/Volatile Market – No Autocall.

| Period | Worst Stock Level | Investment Value | Autocall? | Payout |

| Year 1 | 0.95 | $106,000 | No | – |

| Year 2 | 0.92 | $112,360 | No | – |

| Year 3 | 0.98 | $119,102 | No | – |

| Year 4 | 1.1 | $126,248 | Yes | $126,248 |

Total Return: $126,000 principal.

The longer the note stays active, the higher your cumulative return, thanks to the step-up feature.

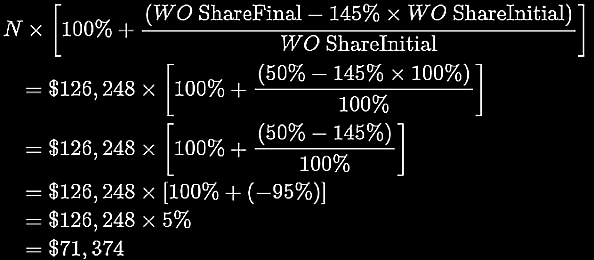

3: Full Term with Market Decline

| Period | Worst Stock Level | Investment Value | Autocall? | Final Performance Impact |

| Year 1 | 95% | $106,000 | No | – |

| Year 2 | 92% | $112,360 | No | – |

| Year 3 | 98% | $119,102 | No | – |

| Year 4 | 50% | $126,248 | No | $71,374 |

Total Return: $71,374 (28.6% loss)

Using the payout formula:

Your investment value grew to $126,248 over 4 years, but the final payout is calculated using the worst-performing stock’s decline to 50% of its initial value.

Summary Table of Scenarios

| Scenario | Investment Value Growth | Final Payout | Total Return | Main Lesson |

| Early Autocall | $19,248 | $119,248 | 19.20% | Quick return, reinvestment risk |

| Sideways/ Volatile Market | $26,248 | $126,248 | 26.20% | Patience rewarded with value growth |

| Market Decline | -$26,248 | $71,374 | -28.60% | Final payout calculated using worst-stock performance formula |

Why Is the Step-Up Feature So Attractive?

1. Enhanced Value Accumulation

The step-up mechanism directly rewards investors for holding through periods of market volatility or slow growth. Instead of being penalized for a lack of immediate performance, investors see their investment value increase over time.

2. Alignment with Growth-Oriented Strategies

By linking the final payout to the performance of leading growth stocks (MSFT, AAPL, JPM), the product is well-suited for investors who are optimistic about the long-term prospects of these companies, but who also want to benefit from accumulated value growth.

3. Compensation for Market Volatility

In volatile markets, asset prices often fluctuate without clear direction. The step-up feature means that every period of uncertainty or delay increases the accumulated value if the autocall trigger is eventually met.

4. Early Redemption Flexibility

The autocall feature allows investors to realize accumulated gains quickly in strong markets, freeing up capital for new opportunities. If the market takes longer to perform, the step-up mechanism ensures that patience builds greater value.

Who Should Consider Step-Up Autocallable Notes?

1. Growth-Focused Investors

Those who believe in the long-term potential of leading companies and want to maximize returns through value accumulation over time.

2. Value Accumulation Seekers

Investors looking for returns significantly higher than traditional bonds or savings accounts, who appreciate the concept of growing investment value.

3. Risk-Aware Investors

Individuals who understand that while their investment value can grow over time, the final payout is subject to market performance at maturity.

4. Long-Term Planners

Investors who are willing to hold for up to 5 years, unless the note is called early, and who value the flexibility of early redemption with accumulated value.

Step-Up Autocallable Notes vs. Fixed Return Products

| Feature | Step-Up Autocallable Note | Fixed Return Product |

| Value Structure | Increases over time if not autocalled | Remains constant throughout the term |

| Response to Volatility | Rewards patience with higher accumulated value | No compensation for delayed performance |

| Early Redemption | Possible with accumulated value if targets are met | Typically not available |

| Market Alignment | Final payout linked to underlying asset performance | Unaffected by market performance |

| Upside Potential | Can be significantly higher if autocall is delayed | Capped at fixed rate |

Advantages in Volatile Markets

The step-up mechanism shines brightest in environments where markets are unpredictable:

- Rising Value Potential: Each period of volatility that delays the autocall increases the accumulated investment value

- Compensation for Delays: Investors build greater value for enduring choppy or sideways markets

- Time for Recovery: The note allows time for market recovery while building value

- Enhanced Growth: The possibility of higher returns than fixed-income alternatives, especially when market timing is uncertain

- Psychological Comfort: Knowing that patience builds value can help investors stay the course during turbulent times

Risks and Considerations

While Step-Up Autocallable Notes offer compelling benefits, investors should be aware of the associated risks:

- Market Risk: Final payout is subject to the performance of underlying assets at maturity

- Issuer Risk: Returns and principal depend on the issuer’s ability to pay

- Liquidity Risk: These notes are not typically traded on open markets and may be difficult to sell before maturity

- Complexity: The step-up and autocall features can be complex; investors should fully understand the terms before investing

- No Downside Protection: Unlike some structured products, there are no barriers protecting your investment from market declines

Why Alpha Quantum Group’s Step-Up Autocallable Note Stands Out

- Blue-Chip Underlyings: Exposure to Microsoft, Apple, and JPMorgan Chase – companies with established track records and growth potential

- Attractive Step-Up Structure: The longer you hold, the higher your accumulated value, with a clear, transparent formula

- Transparent Risk Profile: Clear understanding of how final payouts are calculated based on underlying performance

- Professional Management: Backed by Alpha Quantum Group’s expertise in structuring and managing innovative investment products

Key Features of Alpha Quantum Group’s Step-Up Autocallable Note

- Underlying Assets: Microsoft (MSFT), Apple (AAPL), JP Morgan Chase (JPM)

- Step-Up Rate: Investment value increases by 4.73% for each quarter the note is not autocalled

- Potential Return: Up to 18.18% accumulated value in just 9 months if all three stocks grow by 10% by an observation date

- Maximum Maturity: 5 years

- Performance Risk: Final payout is proportional to the performance of the underlying stocks at maturity

Conclusion

Step-Up Autocallable Notes represent a powerful tool for investors seeking to balance growth accumulation and flexibility in their portfolios. By combining the potential for early redemption with a rising value structure, these notes reward patience and resilience in the face of market volatility. Alpha Quantum Group’s MSFT, AAPL, JPM Step Up Autocallable Note exemplifies how innovative structuring can create value for growth-focused investors, offering a compelling alternative to traditional fixed-income and equity investments.

As with all investment products, it’s essential to understand the risks, read the fine print, and consult with a financial advisor to ensure the strategy aligns with your financial goals. For those seeking to harness the power of accumulated value growth—while being rewarded for the time it takes to get there—Step-Up Autocallable Notes are a solution worth considering.

For more information about Alpha Quantum Group’s structured products, or to discuss how Step-Up Autocallable Notes can fit into your investment strategy, reach out to their advisory team today.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Step-Up Autocallable Notes involve market risk, and investors may lose some or all of their investment. Past performance does not guarantee future results. Please consult with a qualified financial advisor before making any investment decisions.

FAQs

Product Basics & Mechanics

A Step-Up Autocallable Note is a structured investment product that accumulates value through quarterly “step-ups” of 4.73% each quarter, potentially reaching 18.18% returns. Unlike income products, this focuses on capital appreciation, with returns paid only at autocall or maturity.

Every quarter (3 months), your investment value increases by 4.73% regardless of underlying asset performance, as long as assets haven’t fallen below knock-in barriers. This creates a steadily rising return profile that compounds over time.

Autocall occurs when underlying assets close at or above the autocall barrier (typically 100% of initial value) on any quarterly observation date. You then receive your original capital plus all accumulated step-up returns.

Every 3 months, on predetermined dates:

- Asset levels are observed against autocall barriers

- If above barriers: product autocalls with accumulated returns

- If below barriers: another 4.73% step-up is added

- Process continues until autocall or 5-year maturity

60 months (5 years) maximum, with quarterly autocall opportunities. The longer the investment runs without autocalling, the higher your accumulated returns from continued step-ups.

Each additional quarter adds 4.73% to your return:

- 4 quarters = 18.92% total return

- 8 quarters = 37.84% total return

- 12 quarters = 56.76% total return

- Higher volatility can delay autocall, increasing total returns

Step-Up products turn market volatility into an advantage – sideways or declining markets allow more step-ups to accumulate before eventual recovery triggers autocall with enhanced returns.

Underlying Assets & Performance

High-quality, established companies such as:

- Microsoft Corporation (MSFT)

- Apple Inc. (AAPL)

- JP Morgan Chase & Co. (JPM)

- Other blue-chip stocks with strong long-term prospects

- Sometimes broad market indices

Selection emphasizes:

- Long-term growth potential over 5-year horizons

- Lower volatility for more predictable performance

- Strong fundamental business models

- Liquidity for potential product unwinding

- Diversification across sectors when multiple assets used

As long as assets stay above knock-in barriers (typically 60-70% of initial value), step-ups continue accumulating. Only severe declines below these barriers affect the step-up mechanism.

Moderate volatility can be beneficial:

- Prevents early autocall, allowing more step-ups

- Eventually, recovery triggers autocall with accumulated returns

- Higher volatility = potentially higher total returns

- Creates “volatility-to-wealth” conversion opportunity

For large investments ($1M+), customized asset baskets may be possible, but most products use pre-selected, optimized asset combinations designed for optimal risk-return profiles over 5-year periods.

Returns & Accumulation

Each quarter, 4.73% is added to your accumulated return total:

- Quarter 1: 4.73% accumulated return

- Quarter 2: 9.46% accumulated return

- Quarter 3: 14.19% accumulated return

- Quarter 4: 18.18% accumulated return

The maximum return at any given time is 18.18%.

Returns are paid only at:

- Autocall events: When underlying assets trigger early termination

- Maturity: After 5 years if no autocall has occurred

- No interim payments: Unlike Memory products, no quarterly distributions

Market performance of underlying assets:

- Strong markets → early autocall → lower total returns but quicker realization

- Volatile/weak markets → delayed autocall → higher accumulated returns

- Optimal scenario: recovery after 18-24 months with significant accumulation

The 18.18% represents approximately 4 quarters of step-ups (4 × 4.73% = 18.92%). This could be achieved in as little as 18-21 months if assets recover and autocall after the 4th quarterly observation.

Step-up accumulation occurs as long as underlying assets remain above knock-in barriers and the issuer meets obligations. However, severe asset declines or issuer default could affect returns.

Capital Protection & Risks

Step-Up products typically have knock-in barriers (60-70% of initial asset values). If assets never breach these barriers, full capital is returned plus accumulated step-ups. If breached, capital may be at risk based on final asset performance.

If underlying assets fall below knock-in barriers during the investment period:

- Step-up accumulation may stop

- Capital protection may be reduced or eliminated

- Final return depends on asset recovery by maturity

- Accumulated step-ups to breach date are typically still honored

During major market stress:

- Products continue as long as barriers aren’t breached

- Extended periods of low asset prices allow more step-ups

- Recovery from lows can trigger autocall with substantial accumulated returns

- Timing becomes crucial – early recovery benefits from accumulated step-ups

- Market Risk: Severe asset declines below knock-in barriers

- Time Risk: Long investment horizons expose to various market cycles

- Credit Risk: Issuer’s ability to meet payment obligations

- Liquidity Risk: Difficulty exiting before maturity/autocall

- Inflation Risk: Fixed step-up amounts may lose real value over time

These are illiquid investments designed for long-term holding. Early exit before autocall/maturity may be possible through secondary markets but typically involves significant losses due to bid-ask spreads and time value adjustments.

Issued by major investment banks with strong credit ratings. However, 5-year timeline increases credit exposure compared to shorter-term products. Credit analysis of issuers is crucial given extended investment periods.

Market Condition & Scenarios

Optimal scenario: Markets decline or move sideways for 12-24 months (allowing significant step-up accumulation), then recover above autocall barriers, triggering termination with high accumulated returns.

Rising rates can:

- Make fixed step-up returns relatively less attractive

- Affect underlying asset valuations

- Impact secondary market pricing if early exit needed

- Create opportunity cost compared to higher-yielding alternatives

Strong bull markets may trigger early autocalls with limited step-up accumulation:

- Quick autocall after 1-2 quarters

- Lower total returns due to fewer step-ups

- Faster capital return but reduced profit potential

- May not be optimal for Step-Up product performance

Bear markets can be beneficial if not too severe:

- Assets stay above knock-in barriers but below autocall levels

- Extended accumulation period builds higher returns

- Eventually recovery triggers autocall with substantial accumulated gains

- Converts market adversity into investment advantage

Timing is crucial:

- Entry: Best during market uncertainty or mild downturns

- Duration: Longer periods generally increase returns

- Exit: Autocall timing depends on market recovery, not investor choice

- Market cycles: Full cycles often optimize Step-Up performance

Operational & Stregic Considerations

Step-Up products serve as:

- Alternative to traditional growth investments

- Hedge against market volatility

- Long-term capital appreciation component

- Complement to income-producing investments (like Memory products)

- Strategic allocation for patient capital

Ideal for investors who:

- Seek capital appreciation over income

- Can commit capital for 2-5 years

- Understand structured product mechanics

- Want to benefit from market volatility

- Have patience for optimal return realization

Step-Up products offer:

- Structured returns: Predictable step-up accumulation vs market volatility

- Volatility benefit: Sideways markets can enhance returns

- Professional structuring: Optimized risk-return profiles

- Downside buffering: Knock-in barriers provide some protection

- Trade-off: Limited upside in strong bull markets

- Quarterly observation date tracking

- Underlying asset performance monitoring

- Issuer credit quality assessment

- Step-up accumulation verification

- Market condition analysis for autocall probability

Since returns are only paid at autocall/maturity, there’s no opportunity for automatic reinvestment during the investment period. However, proceeds can be reinvested into new products when received.

Advantages:

- Clear, predictable return accumulation

- Volatility becomes beneficial rather than detrimental

- Longer investment horizons for potentially higher returns

- Innovative approach to market participation

Considerations:

- Longer capital commitment periods

- Returns only realized at termination

- Complex interaction between timing and total returns

Newsletter Updates

Enter your email address below and subscribe to our newsletter